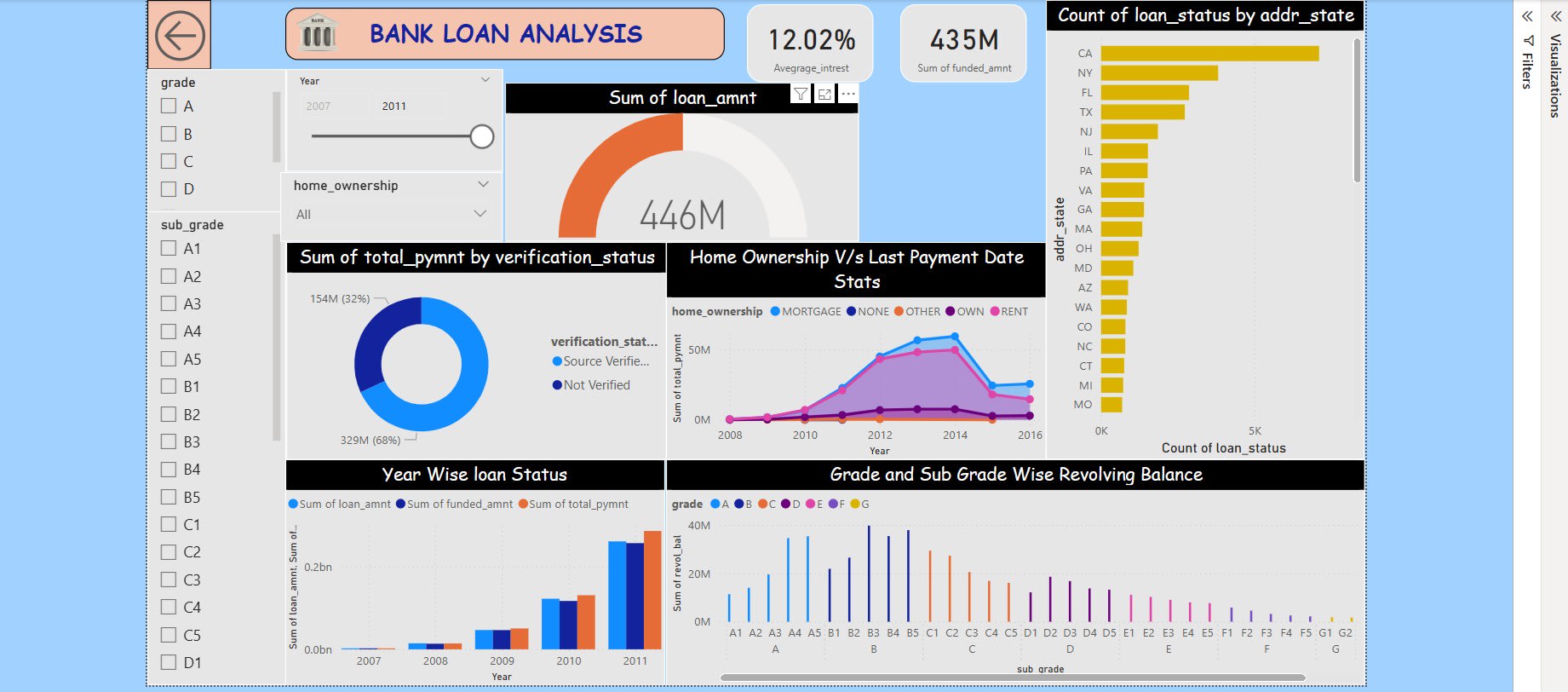

Bank Customer Data Analysis

Objective:

This project provides a detailed analysis of bank customer data. Through these analyses, we aim to provide actionable insights and recommendations for improving loan management and customer engagement strategies.

Source:

Anonymized dataset from a banking system.

Tools Used:

Power Bi

Variables:

Dataset comprised of key variables like Member Id, Loan amount, Funded Amount, Interest Rate, Installment, Grade, Subgrade, Home Ownership, Annual Income, Verification Status, Issue date Loan Status, etc.,

Size: Comprised of 2 excel sheets comprising 35K+ records

Outcome:

1. Statistics reveal trends in borrowing behaviors and economic influences over time.

2. Highlights credit risk levels and inform targeted credit management.

3. Verification status impacts payment reliability.

4.Uncovers regional and temporal patterns, aiding in tailored policies and marketing strategies.

01 Nov 2023