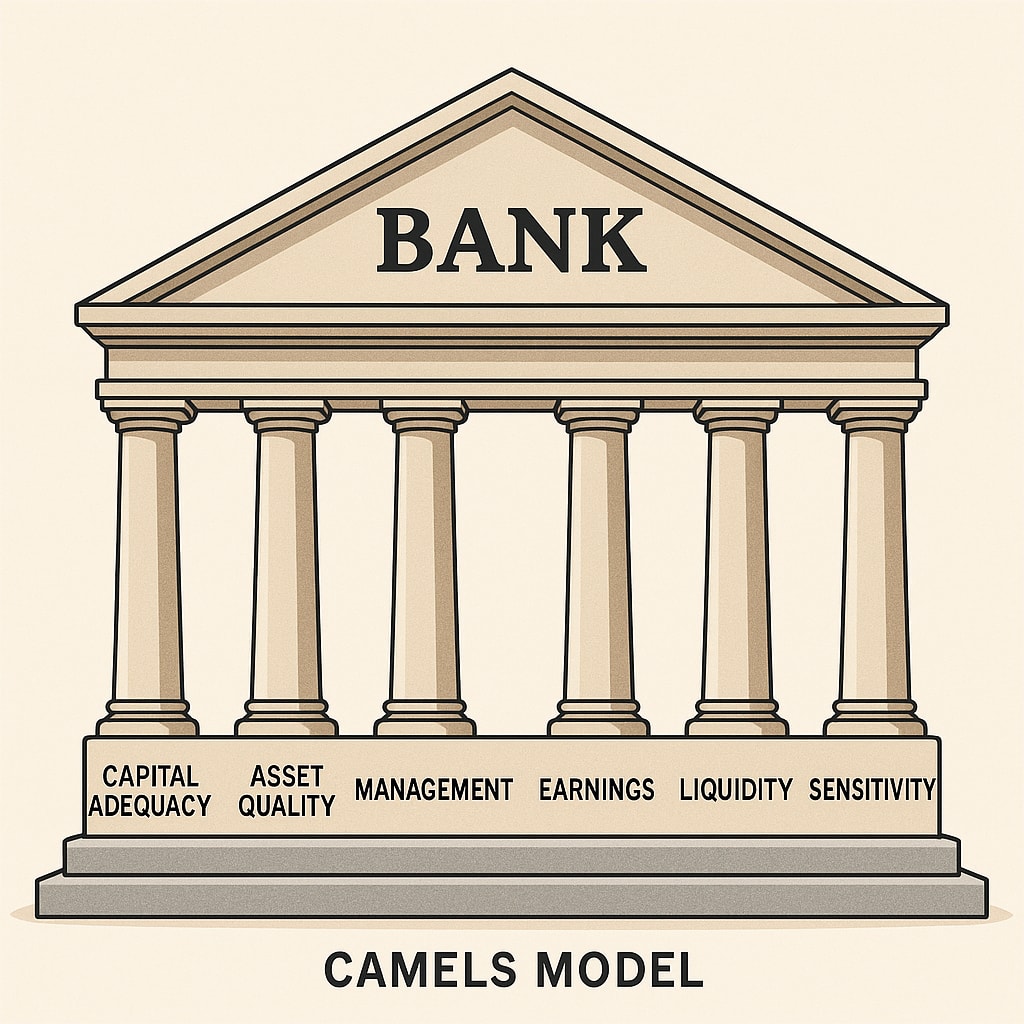

CAMELS MODEL

This project is a comparative financial performance analysis of DBS Bank (Private Sector) and Central Bank of India – CBI (Public Sector) using the CAMELS Model, a globally recognized supervisory framework used to assess the health and stability of commercial banks. The objective of the study was to evaluate both banks across six key dimensions — Capital Adequacy, Asset Quality, Management Efficiency, Earnings, Liquidity, and Sensitivity to Market Risk — and understand how ownership structure influences financial soundness, risk management, and profitability.

The project was completed over a period of three months as part of a Commercial Banking course. During this time, data was collected from annual reports, RBI publications, and verified financial databases. All ratio computations, CAMELS scoring, and trend comparisons were carried out using MS Excel, while the final report and presentation were prepared using MS Word and PowerPoint.

Through this analysis, the project demonstrated clear differences between public and private sector banking performance, especially in areas like earnings strength, asset quality, and capital buffers. The study also enhanced practical skills in financial statement interpretation, banking ratio analysis, and the application of regulatory frameworks.

15 Mar 2025